As of July 4th, 2025, A new tax provision – Section 111001, also known by many in the industry as part of the “One Big Beautiful Bill”—has taken effect, offering a major financial incentive to businesses investing in equipment.

Under this new law, companies can now immediately expense 100% of the cost of qualified property such as CNC machines, automation systems, robotics, and software. The provision applies to equipment placed in service between January 20, 2025, and January 1, 2030.

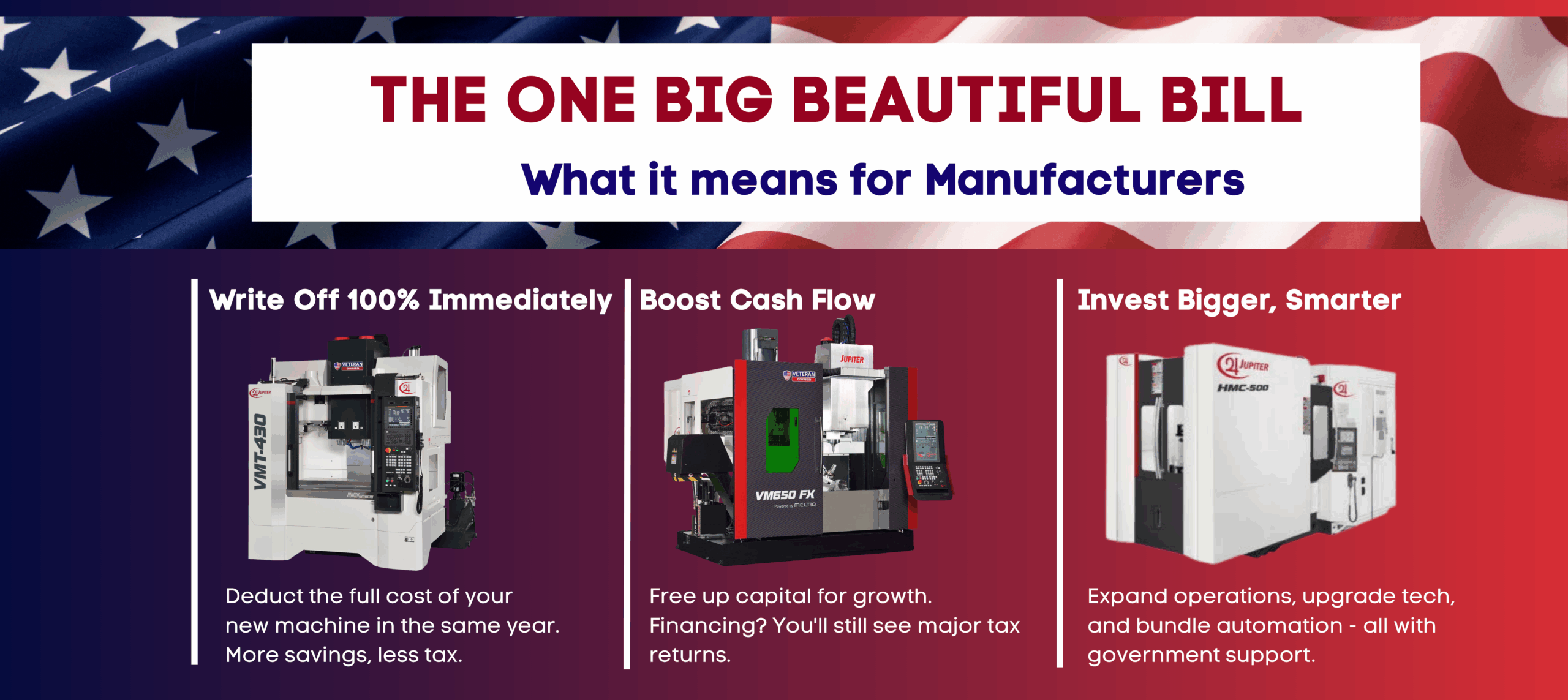

What This Means for Manufacturers:

Full Write-Off: Deduct the entire purchase cost in the same tax year, instead of over several years.

Cash Flow Boost: Businesses taxed at 21% could see up to $210,000 in tax savings on a $1M machine.

Reinvestment Opportunity: Use the savings to upgrade technology, train teams, or expand operations.

Why It Matters:

At Jupiter Machine Tool, we understand how critical capital investments are for innovation and growth in manufacturing. This new tax provision makes it more financially viable for companies to invest in the machines and tools that keep American manufacturing competitive.

Whether you’re planning to expand your line, bring automation in-house, or upgrade older machines, this is a great time to act.

We’re here to guide our customers through the process—from selecting the right equipment to working with your tax advisors to maximize savings.

Use the Section 179 Calculator to estimate your potential tax benefit.

Let us know how we can help you plan your next smart investment.